When Extraction Comes Home

A new piece of EU legislation will dramatically increase mining for rare earth metals across the continent, securing supply chains but damaging landscapes. What happens when we are confronted with the material realities of our consumptive lifestyles?

The land surface revealed by the recent acceleration of Greenland’s melting ice sheet has led to a flurry of exploratory and opportunistic mining projects in the region. Hoping to capitalise on the abundant rare and critical minerals bidden to the surface by the now rapidly diminishing glaciers, prospectors refer to the region as an ‘underexplored’ and ‘emerging’ mining destination. Governments, including the European Union (EU), and corporations such as Bluejay Mining and Anglo American, survey the vast material wealth that, now visibly, characterises this terrain. 1 Bluejay Mining, ‘Projects: Greenland’. Accessed February 16 2024. Source;S & P Global, ‘Greenfields Exploration Eyes a Third of Greenland Acreage Amid Growing Interest’. Accessed February 16 2024. Source

The EU’s Greenland partnership is one example of the types of strategic mining initiatives it is negotiating as part of its recently sealed Critical Raw Materials Act (CRMA). 2 European Commission, ‘EU and Greenland Sign Strategic Partnership on Sustainable Raw Material Value Chains’. Source; European Commission, ‘Critical Raw Materials Act’. Accessed January 31, 2024. Source Recently adopted by the European Council, the regulation was conceived to ensure continuous access to materials deemed critical for Europe’s intertwined digital and green transitions; materials such as lithium, cobalt and nickel, for use in consumer electronic products, solar photovoltaic cells, electric vehicles, wind turbines and heat pumps. 3 European Council, ‘Critical Raw Materials’. Accessed January 31, 2024. Source The act sets out a list of 34 such materials, of which 17 are identified as ‘strategic’, a sub-set of those critical raw materials that are pivotal for green, digital, space and defence applications, and which are likely to face supply issues in the future. Its goals are to boost research and innovation into all critical raw materials, increase and diversify the EU’s supply and enhance critical material circularity, to thereby improve Europe’s overall resource security and sovereignty.

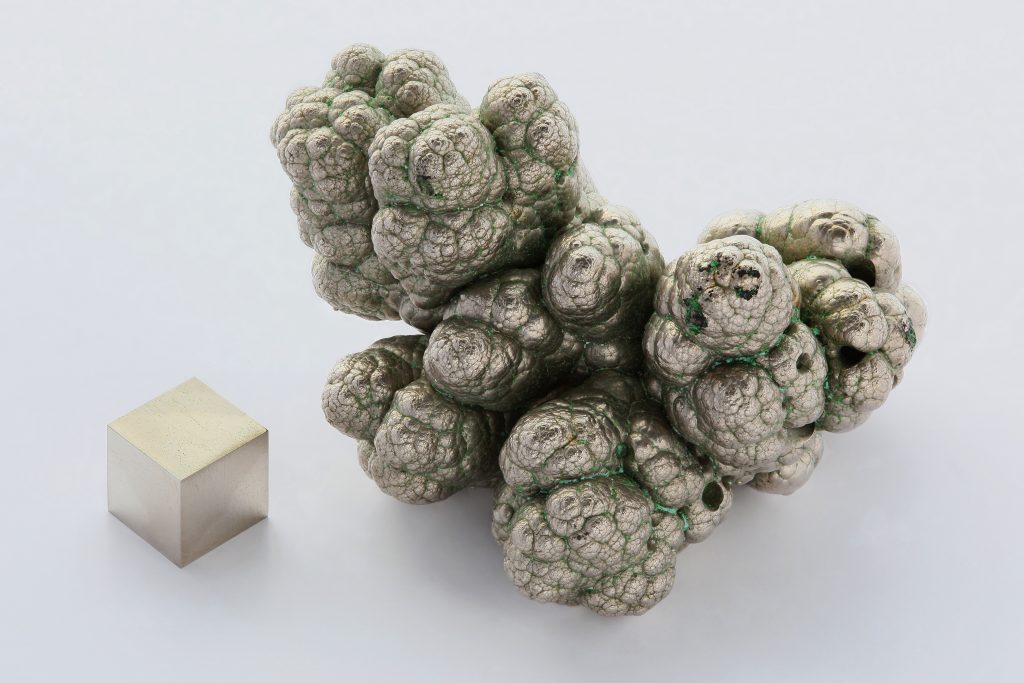

Up to now, these materials have been sourced almost entirely from countries outside the EU – predominantly from China, but also South Africa, Congo, Russia, Mexico and Turkey, among others – through extractive primary industries that have devastated landscapes and populations beyond the region’s borders. The CRMA aims to diversify this list and also, under the auspices of sustainability, seeks to onshore some of these mining activities within the EU via a renewed attentiveness to European geology. Rocks are, after all, the wellsprings of technology minerals and major deposits exist in European peripheries, including Sweden, Portugal, Ireland and Serbia. Yet, this sits uncomfortably with our broader conception of bioregionalism and insufficient consideration of the need to slow down material use and achieve absolute resource decoupling from environmental impacts remains at the centre of the green-tech transition challenge.

The material demand forecasts driving the legislation are both staggering and confounding. The combined goals of providing new technologies that are also green are expected to increase global demand for critical raw materials by 500 per cent, according to some estimates. 4 World Bank, ‘Minerals for Climate Action: The Mineral Intensity of the Clean Energy’. Accessed January 31, 2024. Source; Transition material forecasts are subject to signficant variability between high and low demand scenarios and are affected by multiple factors, such as market displacement through material innovation c/f IEA. ‘The Role of Critical Minerals in Clean Energy Transitions’. Paris: IEA, 2021. Source Scientists calculate that 336 new mines will be needed to meet global electric vehicle demands alone; this includes 59 lithium mines while just 26 are currently in operation globally. 5 European Parliament, ‘EU-US Critical Minerals Agreement: Building Stronger Supply Chains Together’. European Parliament, 2023. Source Similarly, current demand for cobalt is expected to create a global shortfall in the coming decade, and pursuing more ambitious climate goals, without simultaneously tackling material throughput levels, will only drive this demand higher. 6 Anqi Zeng, Wu Chen, Kasper Dalgas Rasmussen, Xuehong Zhu, Maren Lundhaug, Daniel B. Müller, Juan Tan et al., ‘Battery technology and recycling alone will not save the electric mobility transition from future cobalt shortages’, Nature communications 13, no. 1 (2022): 1341. The motive at the heart of the CRMA is not solely to meet the needs of the green transition. The EU has an outsized material footprint, with one of the highest per capita consumption rates globally. 7 14.8 tonnes per capita in 2022 according to the European Environmental Agency. Accessed January 31, 2024. Source Increasing energy demands, our desire to sustain current rates of car use by going electric and astonishingly affluent lifestyles compound the demands for these materials into the future. The numbers don’t stack up. And the absurdism in the rush to establish mines in regions that are newly accessible on account of the effects of anthropogenic climate breakdown is likely clear to most. Our current rate of consumption is challenging to any bioregional vision of life.

While more materially self-sufficient lifestyles are certainly needed in Europe and elsewhere, we might also query the logic of mining expansion when circular design solutions are still largely untapped, and which could relieve the pressure of these colossal material forecasts. The CRMA most notably aligns with movements around design for recycling – it sets a target for sourcing 15 per cent of strategic raw materials through domestic recycling by 2030. 8 The Right to Repair coalition successfully advocated for the inclusion of references to repair and reuse within the draft regulation, though there are no specific targets and it remains to be seen how this will be implemented in practice. Source For designers, the emphasis on recycling will likely mean designing parts and sub-assemblies for ease of separation, removal and reprocessing, as well as adhering to minimum recycled content rates. Nevertheless, recycling these materials is technically very challenging because they are typically used in very small quantities in comparison to base materials, such as hard polymer, steel or alumimum product housings. This will require improved labelling through innovative traceability and recoverability mechanisms, such as barcodes or digital material and product passports. 9 The new EU Batteries Regulation introduces a digital battery passport, which is expected to drive an increase in electric battery collection in the EU by stipulating new mandatory recycling rates. It includes information on the model, recycled content, targets for specific metals recovered from batteries, as well as minimal use cycle information.

While bioregionalism may have a more seamless affinity with sectors such as food or textiles, it can matter for our high-tech products too.

While recycling is necessary to alleviate primary production, much more can be done across the product life cycle than design for recycling. For example, more ambitious integration of higher value circular design strategies is considered by many to be desirable. 10 E-waste is the fastest growing global waste stream and recycling rates have not increased, only been sustained, with demand growth in metals since 2010. IEA, ‘The Role of Critical Minerals in Clean Energy Transitions’, IEA, 2022, 176. Source Such strategies might seek to maintain a product’s integrity and extend its use for as long as possible, for instance by ensuring that parts which are known to fail prematurely are easily accessable in the design layout, to facilitate part servicing, remanufacturing or replacement. One of the most ecologically positive mechanisms for reducing resource demand and extending the life of products is through repair and reuse. Repair ecosystems are local, supported by cultural communities of practice that facilitate social learning and foster bonds of longevity between people, products and places. 11 The grassroots Right to Repair movement has over the last two decades gone from informal communities of local fixer spaces to successfully advocating for supranational European and national US legislation. Repair, ‘Repair’. Accessed January 31, 2024. Source; Repair, ‘Repair’. Accessed January 31, 2024. Source So while bioregionalism may have a more seamless affinity with sectors such as food or textiles, it can matter for our high-tech products too.

More ambitious approaches might include slowing product upgrades by designing replaceable batteries to tackle the current practice of built-in battery charge cycles in consumer electronics that limit the use life of the whole product and ultimately lead to its premature replacement. Over time, certain materials may be removed from the list entirely. For example, recent Chinese restrictions on the global supply of graphite have catalysed EU mining explorations in Scandinavia and Southern Greenland, where reserves are abundant. Yet at the same time, New Zealand-based start-up CarbonScape is developing wood-based biographite materials to substitute graphite use in lithium-ion batteries entirely. Similarly, cobalt-free lithium-ion batteries are also under development by scientists at MIT. 12 IOM3, ‘Biographite from Wood Products’. Accessed January 31, 2024. Source; MIT News, ‘Cobalt Free Batteries Could Power Future Cars’. Accessed January 31, 2024. Source; Chemistry World, ‘Northvolt to Bring Sodium-Ion Batteries to European Market’. Accessed January 31, 2024. Available at: Source. Seeking such eco-innovations in tandem with slowing consumption through repair and reuse to extend product lifetimes is better for the planet and would alleviate the same regional pressures the CRMA seeks to address, without pursuing such ecologically damaging extractive projects.

‘With greater proximity to sources of production comes greater visibility of the damage caused by our overconsumption’

Extraction is a global industry and even the most ethically ambitious of our technologists currently rely on the same global supply chains as market dominant corporations. Dutch pioneer Fairphone has, for several years, been implementing due diligence schemes to tackle the ethical issues in its global material value chains. 13 Fairphone, ‘Supply-Chain Engagement: From Risk to Impact’. Accessed January 31, 2024. Source Throughout the policy debates informing the development of the CRMA, the pitfalls and shortcomings of standards and voluntary agreements in relation to the mining sector have been consistently brought to the fore by non-governmental and campaigning organisations. One key concern relates to whether community consultation on proposed new mines is required or not, particularly in relation to Indigenous communities and their rights, through a framework of ‘free, prior, and informed consent’. 14 Scholars have documented the ineffectiveness of FPIC in the Global South, where it has largely been invoked as a legitimising framework for projects that are already pre-approved by powerful actors. See, for example, Thea Riofrancos, Resource radicals: From petro-nationalism to post-extractivism in Ecuador. Durham: Duke University Press, 2020. Europe’s track record of paying heed to Indigenous voices in this respect has been heavily critiqued for historical wrongdoings. See: Rasmus Kløcker Larsen, Maria Boström, Muonio Reindeer Herding District, Vilhelmina Södra Reindeer Herding District, Voernese Reindeer Herding District and Jenny Wik-Karlsson, ‘The impacts of mining on Sámi lands: A knowledge synthesis from three reindeer herding districts’, The Extractive Industries and Society 9 (2022): 101051. This points to one major challenge to new mining and primary processing activities expected to be established within (and outside) Europe through the act. Communities typically do not want mines in their areas and local resistance to new mining projects across Europe has, to date, been fierce. With the prospect of greater proximity to sources of production comes greater visibility of the bioregional damage caused by our overconsumption; damage which primary production industries leave in their wake and which has, up to now, disproportionately affected regions outside of Europe. As European law, the CRMA poses significant questions about political accountability and the geography of extraction and, ultimately, for the design of our consumptive lifestyles.